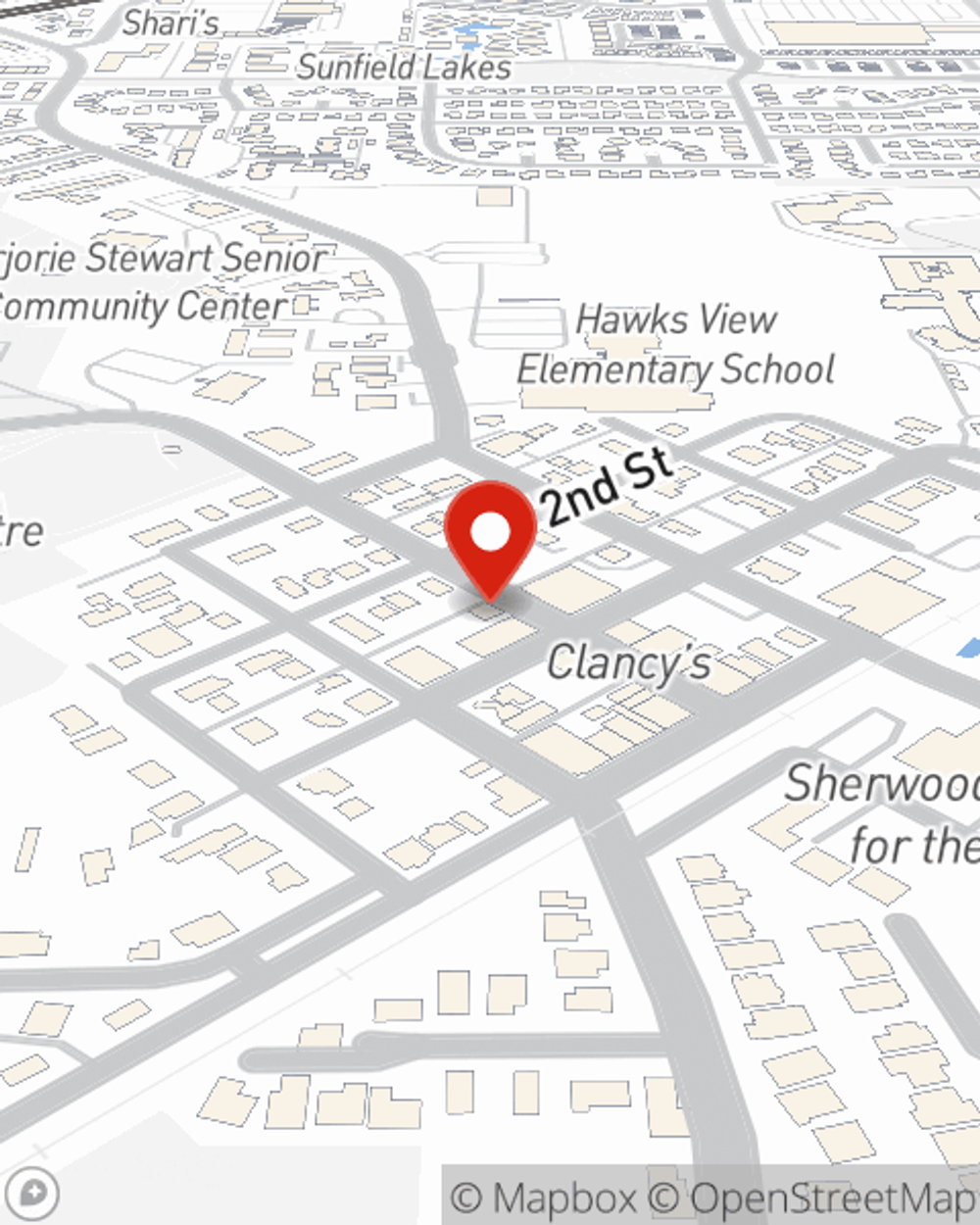

Renters Insurance in and around Sherwood

Renters of Sherwood, State Farm can cover you

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

The place you call home is the cornerstone for everything you cherish. It’s where you build a life with the ones you love. Home is truly where your heart is. That’s why, even if you live in a rented townhome or condo, you should have renters insurance—even if your landlord doesn’t require it. It's coverage for the things you do own, like your furniture and books... even your security blanket. You'll get that with renters insurance from State Farm. Agent Casey Hill can roll out the welcome mat with the dedication and competence to help you protect yourself from the unexpected. Personalized care and service like this is what sets State Farm apart from the rest. When you're covered by State Farm, your rental can be home sweet home.

Renters of Sherwood, State Farm can cover you

Renters insurance can help protect your belongings

Why Renters In Sherwood Choose State Farm

Many renters don't realize that their landlord's insurance only covers the structure. Your valuables in your rented townhome include a wide variety of things like your microwave, desk, tool set, and more. That's why renters insurance can be such a good move. But don't worry, State Farm agent Casey Hill has the experience and dedication needed to help you choose the right policy and help you keep your belongings protected.

Don’t let worries about protecting your personal belongings keep you up at night! Get in touch with State Farm Agent Casey Hill today, and explore how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Casey at (503) 601-2525 or visit our FAQ page.

Simple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Simple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.